Introduction to Techronadvantage Card.com/Myaccount

In today’s economy, every penny counts. For drivers, fuel costs represent a significant portion of their monthly expenses. Finding ways to save money at the pump is a constant pursuit. The Techron Advantage Card, offered through Synchrony Bank, presents a solution for motorists looking to reduce their fuel bills and earn rewards on everyday purchases. This article provides a comprehensive overview of the Techron Advantage Card, focusing on managing your online account at techronadvantagecard.com/myaccount and exploring the various benefits and features that can help you maximize your fuel rewards.

Understanding the Techron Advantage Card

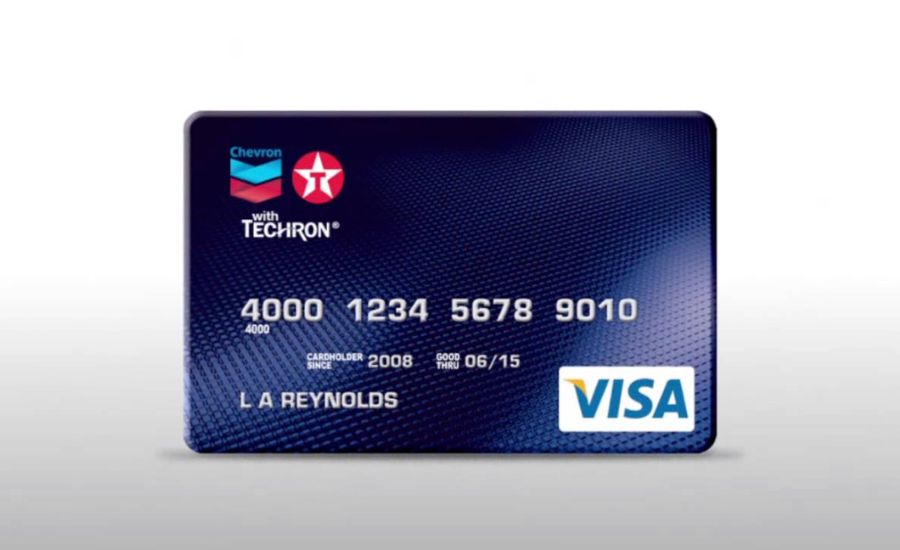

The Techron Advantage Card is a credit card designed specifically for consumers who frequently purchase gasoline and other automotive-related products. The card is linked to the Techron brand, a fuel additive known for its cleaning and performance-enhancing properties. While the card can be used anywhere Visa is accepted, its primary appeal lies in the rewards and benefits offered at Chevron and Texaco gas stations.

Key Features and Benefits:

- Fuel Rewards: The primary benefit of the Techron Advantage Card is the fuel rewards program. Cardholders earn points on eligible purchases, which can then be redeemed for discounts on gasoline at participating Chevron and Texaco stations. The specific rewards structure can vary, but typically involves earning a certain number of points per dollar spent on fuel and other purchases. These points accumulate and can be redeemed for cents-per-gallon discounts, significantly lowering the cost of filling up your tank.

- Everyday Purchase Rewards: While the card’s main focus is fuel, it also offers rewards on other purchases. Cardholders earn points on everyday spending, such as groceries, dining, and entertainment. This allows you to accumulate rewards faster and maximize your savings on fuel. The rewards rate for non-fuel purchases is typically lower than the rate for fuel purchases, but it still provides a valuable incentive to use the card for all your spending.

- Introductory Offers: New cardholders often receive introductory offers, such as bonus points or a temporary increase in the rewards rate. These offers can provide a substantial boost to your rewards balance in the early stages of using the card. It’s essential to read the terms and conditions of these offers carefully to understand the eligibility requirements and expiration dates.

- Online Account Management: The Techron Advantage Card offers convenient online account management through the website techronadvantagecard.com/myaccount. This platform allows cardholders to track their spending, monitor their rewards balance, pay their bills, and access other important account information.

- No Annual Fee: Many iterations of the Techron Advantage Card come with no annual fee, making it an attractive option for consumers who want to earn rewards without incurring additional costs. The absence of an annual fee means that you can reap the benefits of the card without paying a yearly charge, making it a cost-effective way to save on fuel and other purchases.

- Purchase Security: The Techron Advantage Card also provides purchase security benefits, such as fraud protection and zero liability for unauthorized charges. This gives cardholders peace of mind knowing that they are protected against fraudulent activity and unauthorized transactions.

- Visa Acceptance: Because the Techron Advantage Card is a Visa card, it is accepted at millions of locations worldwide. This makes it a convenient payment option for all your purchases, both at home and abroad.

Accessing and Navigating techronadvantagecard.com/myaccount

The online account management portal at techronadvantagecard.com/myaccount is a crucial tool for Techron Advantage Cardholders. It provides a centralized location for managing your account, tracking your rewards, and making payments.

- Registration and Login: To access your online account, you will need to register your card on the website. The registration process typically involves providing your card number, social security number, and other personal information. Once you have registered, you can log in using your username and password.

- Account Summary: The account summary page provides a snapshot of your account activity, including your current balance, available credit, payment due date, and rewards balance. This page allows you to quickly assess your account status and stay informed about your spending and rewards.

- Transaction History: The transaction history page displays a detailed record of all your recent purchases and payments. You can filter your transaction history by date range, transaction type, or merchant to easily find specific transactions. This is a valuable tool for tracking your spending and identifying any potential errors or fraudulent activity.

- Rewards Balance and Redemption: The rewards section of the website allows you to track your accumulated rewards points and redeem them for fuel discounts. You can view your current rewards balance, see how many points you have earned, and choose how you want to redeem your rewards. Typically, you can redeem your rewards at participating Chevron and Texaco stations by swiping your card at the pump or presenting it to the cashier.

- Payment Options: The online account management portal offers various payment options, including online payments, phone payments, and mail-in payments. You can set up recurring payments to ensure that your bills are paid on time and avoid late fees.

- Profile Management: The profile management section allows you to update your personal information, such as your address, phone number, and email address. It is essential to keep your contact information up-to-date so that you can receive important account updates and notifications.

- Security Settings: The security settings section allows you to manage your account security preferences, such as changing your password and setting up security alerts. It is crucial to use strong passwords and enable security alerts to protect your account from unauthorized access.

- Customer Service: The website provides access to customer service resources, such as frequently asked questions, contact information, and online chat support. If you have any questions or issues with your account, you can contact customer service for assistance.

Maximizing Your Fuel Rewards

To get the most out of your Techron Advantage Card, it’s essential to understand how the rewards program works and implement strategies to maximize your earnings.

- Use the Card for All Purchases: To accumulate rewards faster, use your Techron Advantage Card for all your eligible purchases, not just fuel. This includes groceries, dining, entertainment, and other everyday expenses. While the rewards rate for non-fuel purchases may be lower, every point counts towards your fuel savings.

- Take Advantage of Bonus Offers: Keep an eye out for bonus offers and promotions that can boost your rewards earnings. These offers may include bonus points for specific purchases or temporary increases in the rewards rate. Be sure to read the terms and conditions of these offers carefully to understand the eligibility requirements and expiration dates.

- Shop at Chevron and Texaco Stations: To maximize your fuel rewards, make sure to purchase gasoline at participating Chevron and Texaco stations. These stations offer the highest rewards rate for fuel purchases, allowing you to accumulate points faster.

- Redeem Rewards Strategically: Redeem your rewards strategically to maximize your savings. Consider redeeming your rewards when fuel prices are high to get the most value for your points. Also, be aware of any expiration dates on your rewards and redeem them before they expire.

- Monitor Your Rewards Balance: Regularly monitor your rewards balance on the website to track your progress and ensure that you are on track to meet your savings goals. This will also help you identify any potential errors or discrepancies in your rewards earnings.

- Pay Your Bills on Time: To avoid late fees and maintain a good credit score, make sure to pay your bills on time every month. You can set up automatic payments to ensure that your bills are paid on time and avoid any late payment charges.

- Stay Informed About Program Changes: The terms and conditions of the Techron Advantage Card rewards program may change from time to time. Stay informed about any program changes by regularly checking the website and reading any updates or notifications from Synchrony Bank.

Benefits of Using Techron Fuel

The Techron Advantage Card is intrinsically linked to Techron fuel additive, designed to keep engines clean and performing optimally. Understanding the benefits of Techron fuel can further incentivize cardholders to utilize their rewards at Chevron and Texaco stations.

- Engine Cleaning: Techron is a patented fuel additive known for its powerful cleaning properties. It is designed to remove deposits from fuel injectors and intake valves, preventing performance degradation and improving fuel efficiency.

- Performance Enhancement: By keeping engines clean and free of deposits, Techron can help improve engine performance, including acceleration, power, and responsiveness. This can result in a smoother and more enjoyable driving experience.

- Fuel Efficiency: Deposits in the fuel system can reduce fuel efficiency, leading to higher fuel costs. Techron helps maintain optimal fuel efficiency by removing deposits and ensuring that fuel is delivered to the engine in the correct amount and at the correct time.

- Reduced Emissions: By improving combustion efficiency, Techron can help reduce harmful emissions, such as hydrocarbons, carbon monoxide, and nitrogen oxides. This can help improve air quality and reduce your vehicle’s environmental impact.

- Protection Against Corrosion: Techron also provides protection against corrosion in the fuel system, helping to extend the life of your engine and prevent costly repairs.

Responsible Credit Card Usage

While the Techron Advantage Card offers numerous benefits, it’s essential to use it responsibly to avoid debt and maintain a good credit score.

- Pay Your Balance in Full: To avoid interest charges, pay your balance in full each month. If you carry a balance, you will be charged interest, which can quickly erode the value of your rewards.

- Avoid Overspending: Stick to a budget and avoid overspending with your credit card. Only charge what you can afford to pay back each month.

- Monitor Your Credit Score: Regularly monitor your credit score to track your progress and identify any potential issues. A good credit score can help you qualify for lower interest rates on loans and credit cards.

- Be Aware of Fees: Be aware of any fees associated with the card, such as late fees, over-limit fees, and cash advance fees. Avoid these fees by paying your bills on time, staying within your credit limit, and avoiding cash advances.

- Protect Your Card Information: Protect your card information by keeping your card in a safe place and avoiding sharing your card number with anyone. Be cautious of phishing scams and other fraudulent activities.

Alternatives to the Techron Advantage Card

While the Techron Advantage Card offers valuable fuel rewards, it’s essential to consider other credit cards that may offer better rewards or benefits for your specific spending habits.

- General Rewards Credit Cards: General rewards credit cards offer rewards on all purchases, not just fuel. These cards may offer a higher rewards rate or more flexible redemption options than the Techron Advantage Card.

- Travel Rewards Credit Cards: Travel rewards credit cards offer rewards that can be redeemed for flights, hotels, and other travel expenses. If you travel frequently, a travel rewards card may be a better option than the Techron Advantage Card.

- Cash-Back Credit Cards: Cash-back credit cards offer a percentage of your purchases back as cash. If you prefer cash rewards, a cash-back card may be a better option than the Techron Advantage Card.

- Store-Specific Credit Cards: Other gas station or store-specific credit cards may offer better rewards or benefits for your specific spending habits. Compare the rewards programs and benefits of different cards to find the one that best meets your needs.

The Techron Advantage Card can be a valuable tool for drivers looking to save money on fuel and earn rewards on everyday purchases. By understanding the card’s features and benefits, managing your account effectively at techronadvantagecard.com/myaccount, and using the card responsibly, you can maximize your fuel rewards and reduce your overall fuel expenses. However, it’s important to compare the Techron Advantage Card with other credit cards to determine which one best meets your individual needs and spending habits. By carefully considering your options and using your credit card responsibly, you can reap the rewards and achieve your financial goals.

Troubleshooting & FAQs

1. What Should I Do If I Forget My Password?

If you can’t log in to your account, click ‘Forgot Password’ and follow the steps to reset it using your registered email.

2. How Can I Contact Customer Support?

For any issues, call Synchrony Bank Customer Service at 1-866-448-5702.

3. Are There Any Fees Associated with the Techron Advantage Card?

- No annual fee.

- Interest charges may apply if the full balance is not paid by the due date.

4. Can I Use My Techron Advantage Card for Non-Fuel Purchases?

- The Techron Advantage Visa can be used anywhere Visa is accepted.

- The standard Techron Advantage Credit Card can only be used at Chevron and Texaco stations.

5. How Do I Set Up Automatic Payments?

- Log in to techronadvantagecard.com/myaccount.

- Navigate to ‘AutoPay’ under the Payments section.

- Enter your bank details and set a payment schedule.

Final Word

The Techron Advantage Card is an excellent option for frequent drivers who fuel up at Chevron and Texaco stations. With the convenience of techronadvantagecard.com/myaccount, managing payments, tracking rewards, and redeeming discounts has never been easier.

By understanding how to use the Techron Advantage Card effectively, you can save on fuel, earn rewards, and simplify your financial management. Whether you’re looking for fuel discounts or flexible payment options, this card offers plenty of benefits.

Read More About Business At: Prostavivecolibrim